retired attorney

My friend and former colleague, Nicholas Arguimbau, a retired attorney gave me permission to share this with you. I think it's well worth reading, and I you will tell me what you think of it,

It's Time to Call the Shale Gas Revolution as well as "the Mighty Marcellus" a Bust. And Time is Long Overdue to Ask What We're paying the US Energy Information Administration For.

Nicholas C. Arguimbau.

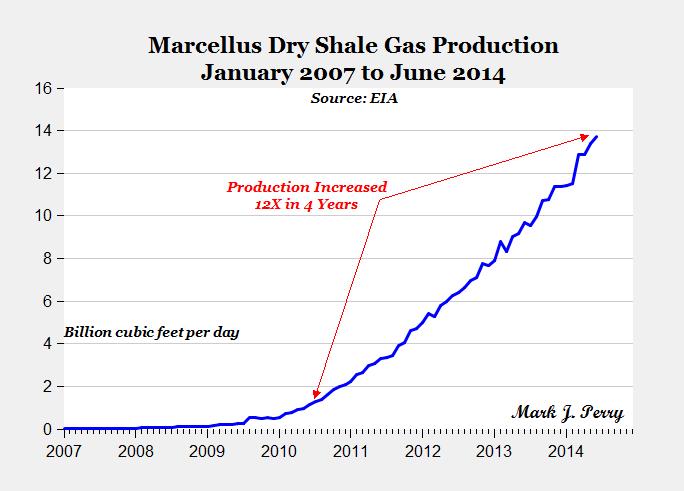

Here's a February 4, 2016 production graph for the United States shale gas industry It's from David Hughes, who's been a natural gas geologist in Canada and the United States for over 35 years. His data are the latest government production statistics. The writer believes it is the most up-to-date graphic display of "peak shale gas" and "peak Marcellus."

These events were predicted by this writer in "2015: Is It The Year Marcellus Shale Gas Peaked And Then Began Falling As Fast As It Rose?"http://www.countercurrents.org/arguimbau210515.htm In the course of research, the writer has learned quite a little not only about the Marcellus shale but about how people go about fooling each other and themselves. Come aboard folr the ride!

These events were predicted by this writer in "2015: Is It The Year Marcellus Shale Gas Peaked And Then Began Falling As Fast As It Rose?"http://www.countercurrents.org/arguimbau210515.htm In the course of research, the writer has learned quite a little not only about the Marcellus shale but about how people go about fooling each other and themselves. Come aboard folr the ride!

hughes february4chart!cid_image001_gif@01D16044.gif

:

The entire US shale gas industry is being brought down by its largest play, the Marcellus, in Pennsylvania and West Virginia. Here's how things look on the ground. Restaurants that used to be packed are now virtually empty. Almost every drilling company company has laid off workers and reduced its capital budget. Drilling rig counts, a surrogate for future new production, dropped by half, from 120 to 59, between 2013 and 2015, and dropped by half again, from 59 to 29, in the last nine months, leaving total production supported primarilly by pre-exiating, "legacy" wells which in shale gas plays typically lose about one third of their present production each year.:

:

The entire US shale gas industry is being brought down by its largest play, the Marcellus, in Pennsylvania and West Virginia. Here's how things look on the ground. Restaurants that used to be packed are now virtually empty. Almost every drilling company company has laid off workers and reduced its capital budget. Drilling rig counts, a surrogate for future new production, dropped by half, from 120 to 59, between 2013 and 2015, and dropped by half again, from 59 to 29, in the last nine months, leaving total production supported primarilly by pre-exiating, "legacy" wells which in shale gas plays typically lose about one third of their present production each year.:

This is no temporary pause caused primarily by a downturn in prices, from which the drillers will inevitably and quickly recover when and if prices recover. The Marcellus took off on its incredible rise shortly after the price of gas dropped 50% into clearly insufficient-to-pay-for-drilling territory.A poorly understood aspect of the entire shale revolution is that it follows a bizarre financial pettern - while the industry has seemingly thrived, the wells alone have almost never paid for themselves in production (See "2015: Is It The Year Marcellus Shale Gas Peaked And Then .. ".http://www.countercurrents.org/arguimbau210515.htm ), and likely never wil, because as the price of gas goes up, likely so will the cost of drilling and fracking,l. Some, folks in the business,notably the CEO of the failng giant, Chesapeake Oil aand Gas, have openly talked about the virtual impossibility of making ends meet from gas sales alone. Needless to say the direct drilling costs are only one part of the costs of running a company. If that is true now it likely always will be. The drillers are disinclined to talk about their finances, so there is a "Those who say don't know and those who know don't say" aspect tol the busuness, but happily a recent study established an accurate cost for drilling and fracking ($7.5 million per well), which may be compared to known figures about wells and their production. . A fracked well, unlike a traditional verticall well. is physcally very complex and has a short life span. If these aspects are sufficient to make them uncompetitive with traditional oil and gas, there is no reason for that to change. Moreover, the fracked-gas driller has to keep drilling constantly because production drops rapidly from existing wells. Production depends more on the rate at which wells are drilled than on the total number of wells, so wells have to keep being drilled as fast as the money coming in will allow. Moreover it is difficult to halt the production of a fracked well once production begins. The net result is that it is difficult to save either incoming money or fracked gas until the price goes up. Billions have been lost that way.

The drillers depend upon two limited resources - the gas, and the investors with the gas leases they are willing to purchase; and when one of them peaks, production peaks; with drilling unable to pay for itself, peak investment inevitably comes before peak gas. And that, in this writer's opinion, is what has happened to Marcellus, and must happen to almost the entire "shale revolution," both oil and gas. They've been mining suckers more than gas and oil, and have hit "peak suckers." It's a Ponzi scheme. This writer is saying nothing new. It's all laid out in the best-documented piece of jpournalism you'll ever read:: Dan Urbina, "Insiders Sound an Alarm Amid a Natural Gas Rush," New York Times June 25, 2011,http://www.nytimes.com/2011/06/26/us/26gas.html. The scam's continuance, bilking investors of billions in the subsequent five years, is a barely believable chronicle of mass societal dysfunction.

There is a remarkable simultaneity in the events of Bakken and Marcellus, but if the companies are to be perceived as"sucker miners" rather than oil and gas drillers thousands of miles apart, then they are competitors for the same limited resource, and the simultaneity makes perfect sense. This writer saw the tell-tale markings of a drying-up limited resource in the steady decline of the Marcellus growth rate starting at the beginning of its clmb, but the mathematics is the same whether the limited resource is gas or suckers, so the growth curves look roughly the same.

There is of course another source of funds that can potentially keep the drilling going in the absence of sufficient income from gas sales: loans. The conventional model of borrowing to start a business, the start-up loan, will provide capital for physical construction, and/or funds for initial operarion before incpome begins to come in sufficient to cover operation and profits Loans in the shale gas business are an entirely different animal. With gas sales insufficient to cover ongoing operations, how can a loan ever be secured or paid off? The answer is to have confidence that the business will always be rapidly growing, and to secure loans against future sales. Future sales can always secure present costs no matter how uneconomical present operations may be. This is Marcellus, up to last year, and it is largely the history of Chesapeake Oil and Gas, the one Marcellus driller with a well-understood history... And by the way,we have just learned how addictive the GDP is if to the great majority of businesses now financed on debt. With a strong GDP, you can finance any business selling widgets for less than they cost.

There is of course another source of funds that can potentially keep the drilling going in the absence of sufficient income from gas sales: loans. The conventional model of borrowing to start a business, the start-up loan, will provide capital for physical construction, and/or funds for initial operarion before incpome begins to come in sufficient to cover operation and profits Loans in the shale gas business are an entirely different animal. With gas sales insufficient to cover ongoing operations, how can a loan ever be secured or paid off? The answer is to have confidence that the business will always be rapidly growing, and to secure loans against future sales. Future sales can always secure present costs no matter how uneconomical present operations may be. This is Marcellus, up to last year, and it is largely the history of Chesapeake Oil and Gas, the one Marcellus driller with a well-understood history... And by the way,we have just learned how addictive the GDP is if to the great majority of businesses now financed on debt. With a strong GDP, you can finance any business selling widgets for less than they cost.

Why doesn't the Energy Information Agency warn us about these things?

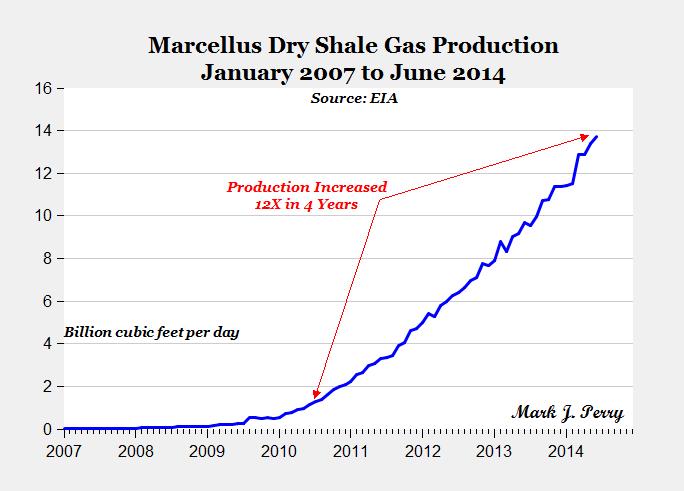

Here is its projection of US natural gas ptoduction - a vision of endless growth, published in 2015, when rig counts for shale gas, not only in the Marcellus but everywhere else, were plummeting, a sure sign of an impending crash.

shale-resources-remain-dom.png

A chart like this one and many similar ones ialso mply ultimate production many itimes that which has been found by USGS to be possiblee with existing technology, yet EIA fails to explain what new technology would be necessary or when if ever it might be developed. In the case of Marcellus the discrepencies are explicit, becaujse USGS had concluded that Marcellus had technically recoverable reserves of 84 trillion cubic feet of gas, EIA conceded that to be correct, yet' EIA's projection implied ultimate production of several times the technically recoverable reserves, an impossibility in the absence of new unknown technology. That's something EIA keeps to itself. Investors see EIA's "up into the wild blue yonder" charts and assume they are buying into a sure thing. EIA projections like this one are essentially fraudulent, and instead of warning investors that they are falling into a trap, assure them that their investments have the security of gold.

This is nothing new

When EIA's staff were internally meeting in 2009 to discuss "peak oil" issues, they used a chart which showed worldwide production of conventional petroleum plummeting after 2012, yet publicly, EIA was claiming that peak oil would not occur until the 2030s. The same non-public chart's decline rates are reflected in the goals set for fossil energy reduction in the Waxman-Markey bill and in the goals set in the later Kerry bill, so it appears that EIA perceived reality one way, but described reality completely differently. The difference made it appear that the industry was being asked to cut their ultimate production severely, when in reality the proposed legislative goals did little more than require that the industry not extract more oil than existed.

It has been assumed for half a century, based upon oil geologists' experience, that an oil reserve's peak production occurs roughjly at the same time as half of the reserve has been expended. At the middle of the last decade, roughly one trillion barrels of oil had been produced and all the world's leading energy agencies (but one) perceived that approximately one trillion barrels remained, implying that peak conventional oil would occur in the middle of the last decade. In fact it did. The one dissenting agency was EIA, which claimed that there were two trillion, not one trillion, barrels of conventional oil yet to be exploited, In part this claim came from an absuredly optimistic assumption as to discovery of new conventional-oil reserves. Discoveries had been steadily dropping since the seventies, when they peaked. It has always taken approximately 30 years to progress from discovery to peak production of an oil reserve, and consequently, peak production pretty much had to be 30 years beyond the seventies. As the famous oil geologist ___ Campbell aptly put it, "You can't produce it before you discover it." EIA's contrary assumption was based upon the downward slope of discoveries dramatically reversing itself for no believable reason.

That was the first device used by EIA to talk itself out of a peak in the last decade. The second was a steadfast reliance upon OPEC's numbers as to its reserves. OPEC reserve numbers had been known for decades to be manufactured to permit individual countries to expand production in accordance with an OPEC rule tying production to reserves. When a report from Oxford University, which has never been challenged, stated that the OPEC reserve number overstated reserves by an amount equal to a full decade's global production at current rates, that didn't faze EIA. OPEC's fraud became EIA's fraud.

You may read the details of the above, with ample documentation, in this writer's "The Imminent Crash Of Oil Supply -www.countercurrents.org/arguimbau230410.htm

And then there is the subjectg of what "oil" is. Naturally enough, most folks equate "oil" with petroleum, and assume as much when they read a chart. EIA makes many more charts of "oil" production these days than of petroleum production. Some smart type apparently observed that since peak natural gas was expected to come later than peak petroleum, peak "oil" woujld be later than peak petroleum if some portion of natural gas was redefined as "oil." It's the sort of word play for which oil and gas lawyers are famous. Or so it seems, because "oil" acquired a definition including within it, a portion of the natural gas known as "natural gas liquids." The notion has a sound of rationality to it until you learn what the natural gas liquids (NGLs) are.

This writer became familiar with them 35 years ago when invited to speak about the Dow Chemical Company in Alaska, where Mitsubishi and Dow were investigating whether to build a plant on the North Slope to manufacture petrochemicals with them. They re absolutely not part of the oil but part of the natural gas, which was the whole trouble with them. In an arctic climate, they condense in a natural gas pipeline and prevent it from functioning, and, when the Mitsubishi-Dow project failed, forced all the natural gas from the North Slope to be flared. If they had been part of the oil, there would not have been a problem. So NGLs became famous. In subarctic climates, they are neither liquid nor a substitute for petroleum, and are transported in natural gas pipelines. But a chart of current "oil" production is roughly flat, reflecting the continuing growth of natural gas production, with its NGLs, whereas a chart of current petroleum production is downsloped. How convenient!. "Thanks to the shale revolution, oil production has not yet peaked." I guess this is what you call a "white lie."

And so it goes. EIA seems incapable of drawing a public chart with a future downslope.

The economic hopes and fears of everyone in the world rise and fall on what EIA has to say, There is an uncanny equivalence between energy consumption and the gross domestic product, and there are those who say it iso mpossiblre to decouple them.Tverberg, "Is it really possible to decouple GDP Growth from Energy Growth?" https://ourfiniteworld.com/…/is-it-really-possible-to-deco…/ Congress, to its credit, attempted to decoujple the politics of GDP from the number-crunching of EIA. Not only was EIA made separate from all other United States government entities, but an agency was created to audit its work, the Professional Audit Review Team. Both have failed miserably, as demonstrated by the above few examples. .. In this writer's opinion, a good method fro straightening tings out would be for people to demand details of the analysis under the Freedom of Iformatikon Act when confronted with a wildly wrong prediction. The ability of government analysts to fudge knows no bounds, but when we fail to use the tools available, we have little more than ourselves to blame folr the results.

A note: The writer has omitted some links for convenience of reading. If in need, the reader should be able to find the links by reading the New York Times piece and my articles

"The Imminent Crash Of Oil Supply -www.countercurrents.org/arguimbau230410.htm and "2015: Is It The Year Marcellus Shale Gas Peaked And Then ..

[Key words: Marcellus, Ponzi scheme, peak Marcellus, peak shale gas, David Hughes, Chesapeake Oil and Gas, rig counts.],

###################

The author is a retired lawyer who lives happily with his dog and cat and 40 fruit trees in Western Massachusetts.He is doing a little on a personal level notwithstanding Naomi Klein’s declaration that we can and apparently should do nothing to reduce CO2 emissions at all until the revolution comes. The fossil fuel industry would naturally endorse her position because (1) The carbon budget will long be exhausted before the revolution comes, (2) the revolution will never come unless its adherents have put aside the capitalists’ greed and sociopathy and replaced them with Henry Thoreau’s ethics and moderation, and (3) the industry would go broke if people boycotted its products. The writer’s colleagues say he is "religious" or "unscientific" or "immorally trying to look better than other people." They are likely right. How can we ever understand our quirks? In any event the author has no car, keeps his thermostat at 50, purchases no silly plastic electronics from China, maintains a vegetarian diet that should be vegan etc. but a long way from zero carbon. It’s easy to be conscientious if your are poor :-); may the limits to growth make us all very poor very soon. If 7 billion people did the same they could look their grandchildren in the eyes and say"We tried to make things OK for you." Without grandchildren the writer tries to say the same to his blameless neighboring chickadees.

reductions if more of the public were practicing real emissions reductions. He hopes others will do likewise.

No comments:

Post a Comment